THE CLARA | New 81-Unit Affordable Housing Project Coming To Historic Anacostia

Hot from the Congress Heights on the Rise inbox:

DCHFA Closes Out Fiscal Year 2021 By Financing Affordable Housing in Wards 6 and 8

Washington, D.C., Oct 08, 2021 -- The District of Columbia Housing Finance Agency (DCHFA) has closed out Fiscal Year 2021 by issuing more than $53 million in tax exempt bonds for the construction of 182 affordable apartment homes. DCHFA has financed two new construction projects, MDXL Flats and The Clara in Wards 6 and 8, respectively.

“Being able to close these deals before the end of the fiscal year was a labor of love. Because of the dedication of the Agency’s team alongside our development and financial partners, we were able to fund two transit-oriented projects that will provide much-needed affordable, beautiful and healthy housing across two wards of the District,” stated Christopher E. Donald, Executive Director/CEO, DCHFA. “The Clara and MDXL Flats will get us 182 units closer to Mayor Bowser’s goal of 12,000 more affordable homes by 2025.”

MDXL Flats will consist of 101 apartments located at 1530 First Street, SW. The $33.4 million in bond financing issued on September 29, 2021 was secured by HUD insured mortgage loans made under DCHFA’s Level I Risk Share Program. DCHFA is the only Risk Share lender in the District of Columbia. The Agency underwrote $28.3 million in Low Income Housing Tax Credits (LIHTCs), and the Department of Housing and Community Development (DHCD) provided an additional $13 million loan through its Housing Production Trust Fund (HPTF). The property will consist of one-, two-, three- and four-bedroom apartments, 21 of which will be designated permanent supportive housing (PSH) reserved for residents earning 30 percent or less of the area median income (AMI) and 80 reserved for those earning 50 percent or less AMI. TM Associates, UPO Community Development Corporation, and Manna are the developers on this project. Amenities will include a below-grade parking garage, bike storage, mail and package rooms, balconies, patios, in-unit washers and dryers and an outdoor picnic area.

MDXL Flats in Ward 6 - rendering by PGN Architects

On the same day, DCHFA closed on The Clara, 81 units in Ward 8’s Anacostia neighborhood. The Agency issued $19.7 million in tax exempt bonds and underwrote $16.9 million in LIHTCs. Additional funding included a $14 million HPTF loan. Twenty apartments will be reserved for residents earning 30 percent or less AMI, and the remaining 61 will be reserved for those earning 50 percent or less. The development will consist of studio, one-, two-, and three-bedroom apartment homes. Amenities will include an underground garage with additional surface-level parking, bike storage, fitness center, service space featuring an Amazon Hub, and more than 5,000 square feet or retail space. Banneker Ventures and Medina Living Ideas for Family Excellence Community Development Corporation make up the development team.

The District of Columbia Housing Finance Agency is an S&P A + rated issuer, serving Washington, D.C.’s residents for more than 40 years. The Agency’s mission is to advance the District of Columbia’s housing priorities; the Agency invests in affordable housing and neighborhood development, which provides pathways for D.C. residents to transform their lives. We accomplish our mission by delivering the most efficient and effective sources of capital available in the market to finance rental housing and to create homeownership opportunities.

The Clara on MLK in Ward 8- rendering by dp + partners

From The Advoc8te:

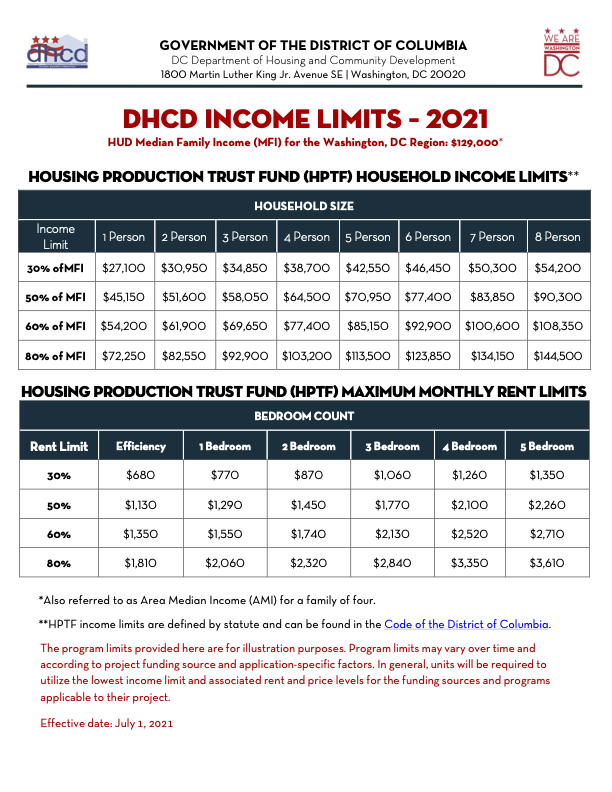

I know most people aren’t familiar with the AMI rates and that that means, so I am attaching DHCD’s 2021 Housing Production Trust Fund (HPTF) Program Limits. See below for details.

PLEASE NOTE: I don’t know the specific rents for The Clara or the income caps for the units; I’m just sharing this information to keep readers informed. From the DC Department of Housing and Community Development:

“Tuesday, August 24, 2021

Maximum Household Income Limits, rents and purchase prices are based on the Washington Metropolitan Statistical Area 2020 Median Family Income (MFI), previously referred to as Area Median Income (AMI), of $129,000 for a household of four, as published by the U.S. Department of Housing and Urban Development (HUD) on April 1, 2021.

Income and Rent Limits for the HPTF program.”