My $91,513 student loan FORGIVENESS story!

IT’S WAS A MIRACLE

AND IT CAN HAPPEN FOR YOU. HERE’S HOW.

December 7th, 2023, will be among my most memorable days. I screamed. I gave praises. I joyfully danced half-dressed in my living room with the blinds up. Undoubtedly, my Electric Slide greatly entertained the bulldog in the apartment across the street and more than one or two neighbors. That morning, I found out that my $91,513 in student loans had been forgiven!

Since sharing the good news, I've received many questions about how my loans were forgiven. I put together this Public Service Announcement to help others.

My Origin Story & The Super Villains

I graduated in 2002 from Howard University with a B.S. in Biology and about $32,000 in student loan debt. For the next 21 years, my loans were in forbearance or deferment. I made only two payments during the life of my loans for a total of $80. Yup, you read that right, four $20 bills.

I decided long ago that Navient would have to take my money out of my cold, dead hands. I wasn't against repaying my student loans, but the compound interest was absurd and bordered on usury.

So I had done the math; even if I paid $1,000/month, It would all go to interest without touching the principal. Navient, Nelnet & Sallie Mae are the Stringer Bells of the student loan game.

The Gamble

I hoped/prayed/believed that the federal government would have to address the student loan crisis at some point in my lifetime because too many people were drowning financially or were like me and would never pay off the loans. Besides, I had other obligations (like food, housing, and healthcare), which were more critical than Navient getting rich because I needed a college education.

The Pay Off

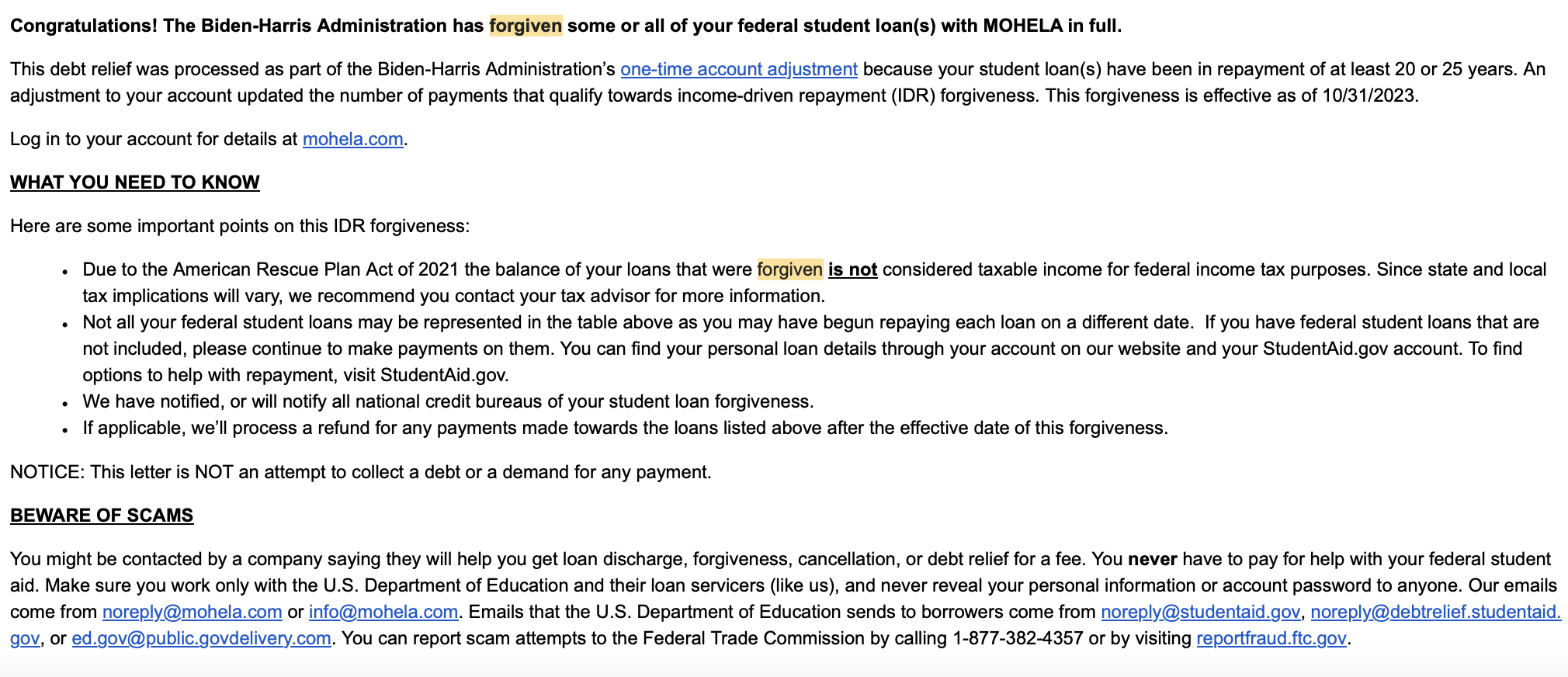

And it happened! Thanks to the Biden/Harris administration, several new student loan forgiveness and repayment programs have been rolled out. I took advantage of the one-time IDR (Income Driven Repayment) Adjustment, also known as the Payment Count Adjustment. That led to this life-changing email.

WHAT YOU NEED TO KNOW

Highlights of the Payment Adjustment for Eligible Borrowers

"ED will conduct an adjustment of IDR-qualifying payments for all William D. Ford Federal Direct Loan (Direct Loan) Program and federally-owned Federal Family Education Loan (FFEL) Program loans.

The payment count adjustment will count time toward IDR forgiveness, including

any months in a repayment status, regardless of the payments made, loan type, or repayment plan;

12 or more months of consecutive forbearance or 36 or more months of cumulative forbearance;

any months spent in economic hardship or military deferments in 2013 or later;

any months spent in any deferment (with the exception of in-school deferment) prior to 2013; and

any time in repayment (or deferment or forbearance, if applicable) on earlier loans before consolidation of those loans into a consolidation loan.

Generally, repayment status includes any periods where the borrower was enrolled in a repayment plan. Repayment status does not include periods in forbearance, deferment, bankruptcy, or default. However, certain periods of forbearance, deferment, or default will count toward forgiveness in the circumstances described above.

Any borrowers with loans that have accumulated eligible time in repayment of at least 20 or 25 years will see automatic forgiveness, even if they are not currently on an IDR plan.

Borrowers will continue to see the COVID-19 related forbearances counted toward IDR and PSLF forgiveness.

We encourage borrowers who have commercially managed FFEL, Perkins, or Health Education Assistance Loan (HEAL) Program loans to apply for a Direct Consolidation Loan by April 30, 2024, to get the full benefits of the payment count adjustment.

In most cases if borrowers made qualifying payments that exceed the applicable forgiveness period (20 or 25 years), they will receive a refund for their overpayment."

I didn't have to apply for the payment adjustment. It was automatic - well, sort of. In 2022, my student loans were held by Navient (a commercial lender and royal pain in the butt). To qualify for the adjustment (and the other new forgiveness programs), loans must be owned by the U.S. Department of Education (ED).

That was an easy and quick fix! In 2022, I applied online at studentaid.gov to have my student loans with Navient consolidated, which means the government paid Navient for my loans, and then the government (the Department of Education) owned my loans. The online application took less than 10 minutes.

That said, filling out the loan consolidation application for my [REDACTED BECAUSE SHE WOULD KILL ME] was an exercise in self-control. With me filling out the form with her on the phone answering the questions, it took about 30 minutes, patience, a stiff drink, Jesus, and two angry hang-ups. But we got it done! Like many people, [REDACTED] did not know about these forgiveness programs until I called screaming, "I'm debt-free! Guess who's going to Applebee's!"

Now, back to my student loan forgiveness journey. After processing the loan consolidation (about 45 days), the Department of Education now owned my loans. Mohella was my new service provider; the loans were now Direct Loans. That meant that my loans now qualified for the NEW AND TEMPORARY forgiveness programs (like the IDR Adjustment) offered by the Biden/Harris Administration under the SAVE Act. Also, new repayment plans will prevent the need to eat Top Ramen for the rest of your life.

So, if you want to take advantage of these new programs but have a commercially held student loan, APPLY TO HAVE YOUR LOAN(S) CONSOLIDATED BY THE FEDERAL GOVERNMENT BY APRIL 30TH, 2024 (the previous deadline was December 31st, 2023). Do you need to know if your student loans are owned by a commercial lender or the U.S. Dept of Education? Click this link for a list of phone numbers to call and ask. If the Department of Education already owns your loans, they will automatically recount your payments as part of the new adjustment.

WHAT YOU NEED TO KNOW

About the adjustment deadlines and timelines:

"The U.S. Department of Education (ED) currently expects that the payment count adjustment will be completed by July 1, 2024. When we implement the adjustment, it will automatically be applied to all Direct Loans and FFEL Program loans that are managed by ED at that time. This includes Direct Consolidation Loans that repaid a privately held Perkins or FFEL Program loan and that are disbursed before the adjustment occurs.

Please note that submitting a consolidation application alone does not guarantee any benefits under the payment count adjustment. In general, it takes at least 60 days to process a Direct Consolidation Loan application and to disburse the new loan. This means that if you want to consolidate your loan(s) in order to get the benefit of the adjustment, you should submit a loan consolidation application by April 30, 2024."

And they lived happily ever after.

Imagine what you could do without the financial burden of student loan payments. You could buy a home, go on vacation, pay off other debt, save for retirement, or stop eating Top Ramen all the time! Now, please pick up the phone or go online and do something about these damn loans. Another great local resource is the DC Student Loan Ombudsman. It's free, and they want to help you.

Let's break the cycle of generational financial instability. People of color carry the highest average student loan debt and generally have the fewest financial resources to repay. Loan forgiveness can open up many opportunities to improve your financial and emotional health. For example, I had no personal debt once my student loans were forgiven. Before the loan forgiveness, my credit score was around 800 (which is still very good) out of 850. After the loan forgiveness, my score jumped to 829 out of 850 and was considered "exceptional." If I ever want to take out another loan or credit card - and I won't - my interest rate should be among the lowest.

This email was long, but I hope you found this information helpful and encouraging. If so, please drop me a line. I would love to hear it. Don't lose hope. Don't give up. You, too, could be acting a total fool in your living for the entire world to see!

Now, please share this with your networks!

Your pal,

The Advoc8te

congressheightsontherise.com

Click here to subscribe to the free CHotR Daily Digest email.